The Black Friday Bounce Back 📈

Scarlet, December 13, 2024

For many eCommerce retailers, entering the autumn/winter (AW) season was anything but smooth. Consumer confidence was at a low point, with shoppers closely evaluating their financial situations, the state of the economy, business conditions, and job markets.

The Consumer Confidence Index highlights a simple truth: when consumers feel optimistic, they spend more, boosting the economy. When pessimism sets in, spending drops and buyers pull back.

As advertisers, we see these shifts unfolding at lightning speed. Average Order Value (AOV) and overall online revenues steadily declined, undoing what had been a buoyant year to date for many clients across various industries and markets.

This shift in consumer behaviour & buying habits was always going to be unsettling for brands and campaign managers. As an agency, we held our nerve and prepared for ‘discount season’ with a bullish but cautious sense of optimism.

Cue Black Friday preparation

We, and our clients, get excited about Black Friday because it offers an incredible opportunity to achieve multiple goals all at once:

Maximising Revenue: Black Friday is a peak sales moment, where our clients can drive a significant surge in revenue

Shifting Dead Stock: It’s the perfect time to clear out slow-moving or older inventory, freeing up space for new products and boosting cash flow.

Winning New Customers: The event attracts a huge influx of shoppers, many of whom may not have purchased from your brand before.

Increasing the Bottom Line: Black Friday can significantly enhance overall profitability, ensuring the effort pays off long after the event is over.

Finding the magic sauce for a successful Black Friday

Regrettably, there is no single recipe that can be applied. What we do know is that achieving exceptional results rarely happens by accident. Our job is to initiate well-constructed Ad strategies using a range of data points and historical trends.

The best-performing brands were organised, they knew their numbers and understood the importance of knowing your Unit Economics and most importantly they know their audience.

By Setting a benchmark we knew what to expect….

Increased competition amongst advertisers across all key digital platforms

Saturation of uninspiring discount activity

Delays in platform approval

Declining Average Order Value (AOV)

Our Black Friday 2024 Unwrapped

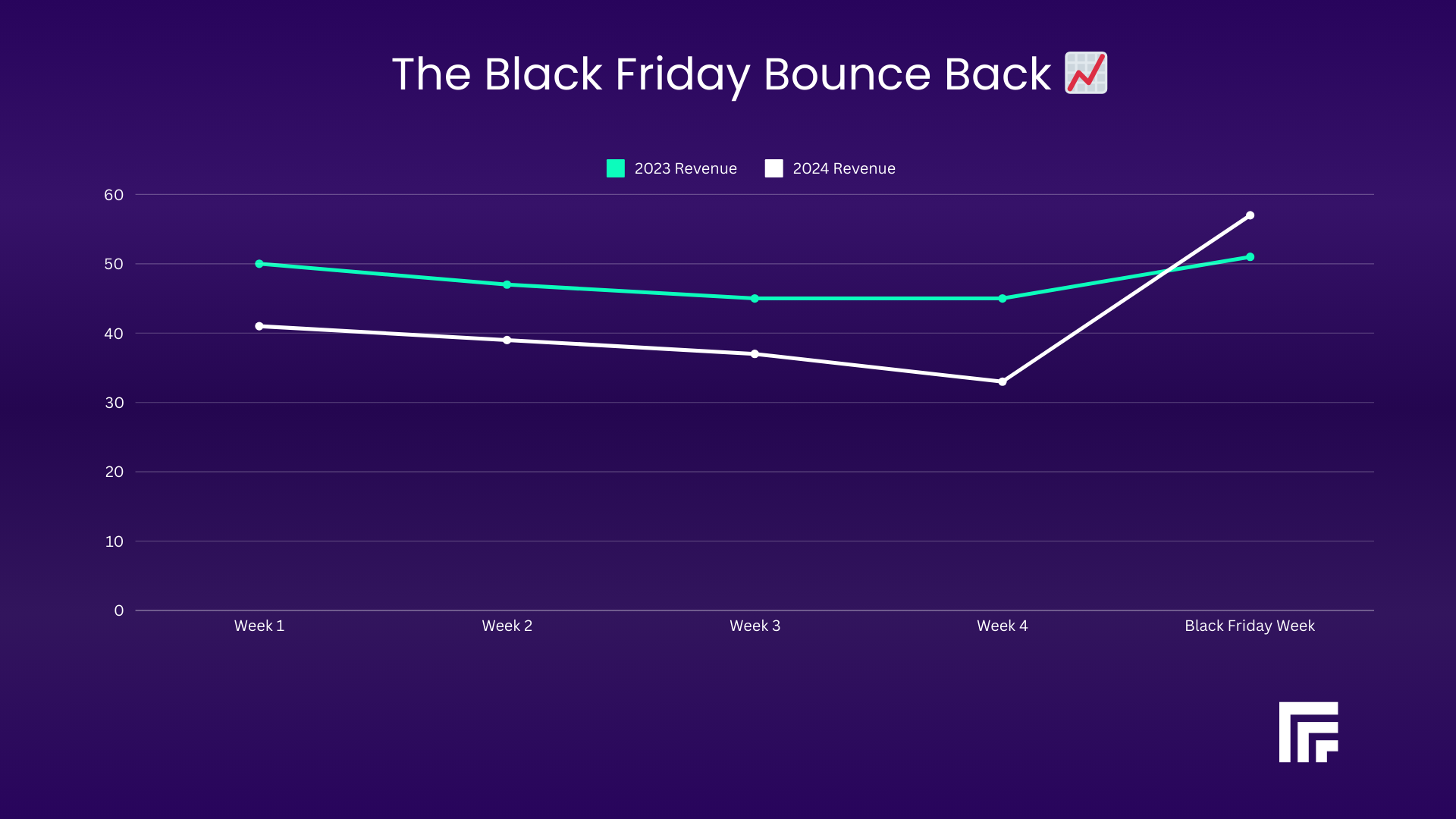

Here’s how things unfolded in the weeks leading up to Black Friday compared to the same period in 2023:

Week 1: Revenue dropped by 17%, while the average order value (AOV) declined by 8%.

Week 2: Revenue was down 21%, with AOV slipping 8%.

Week 3: Revenue continued to slide, down 22%, and AOV fell by 7%.

Week 4: Revenue remained 19% lower than last year, and AOV dipped by 8%.

What Does This Data Mean?

At first glance, these consistent year-on-year declines might seem alarming. But they reflect a broader economic trend: consumers are becoming more cautious about their spending. With rising costs, inflation, and economic uncertainty, people are delaying purchases, hoping to find deeper discounts during Black Friday and Cyber Monday sales.

Revenue vs. AOV

It’s also important to note the relationship between Revenue and AOV (Average Order Value). While revenue shows the total money generated, AOV reflects the average amount spent per transaction.

The fact that both are declining suggests not only fewer sales but also smaller baskets when customers do make purchases. This highlights how economic pressures are influencing not just the volume but also the nature of consumer spending.

The Day Everything Changed…

Everything changed during Black Friday week (W/C 25 November). Revenue surged +31% YoY, while AOV saw a modest but meaningful increase of +2% YoY when typically we expect AOV to drop during sales and promotions.

However, not every brand experienced this uplift equally. Some clients opted to launch their Black Friday promotions early to capture early shoppers. While this seemed like a logical move after a tough October, it had unintended consequences. Many consumers still waited for the actual Black Friday weekend to see if better offers would emerge, leaving early-bird brands with muted results compared to previous years as seen in Forbes Black Friday Insights.

In contrast, clients who concentrated their promotions around the Black Friday/Cyber Monday weekend saw significantly higher sales year-on-year. Block reported a 16% growth in online sales and a 31% rise in in-store purchases. Online transactions, however, boasted cart sizes four times larger than in-person purchases.

How did we Shift our Approach this year?

This year, we approached things differently, enabling us to build on last year’s successes and deliver even stronger outcomes. The most successful strategies we implemented included:

1. Clear, Simple Discounts

Sitewide promotions that were easy for consumers to understand proved most effective. Shoppers didn’t want to navigate complicated offers—they were drawn to straightforward deals.

2. Early Audience Engagement

Brands that warmed up their audiences ahead of Black Friday weekend, through email marketing or exclusive early access for subscribers, saw the best results.

3. Strategic Timing

Focusing discounts on Black Friday itself capitalised on peak consumer interest, rather than spreading promotions too thinly over several weeks.

A Unique Year for Black Friday

This year, Black Friday seemed more impactful than in prior years. Lower consumer confidence meant that many shoppers held out for the most compelling deals. For brands that timed their promotions right, this presented a golden opportunity to drive significant sales.

Looking Ahead

The lessons from this season are clear:

Timing matters — starting too early can dilute the impact.

Clear, simple messaging wins.

Audience engagement before major events can make all the difference.

As we plan for the next big retail moments in 2024, it’s more important than ever to learn from these trends. By understanding consumer behaviour and adapting strategies accordingly, E-commerce brands can stay ahead of the curve—even in challenging market conditions.

Are you ready to maximise your next seasonal campaign? Book a Call to create a strategy that delivers.